Investing in the Best: Why iShares Core S&P 500 ETF Stands Out

BlogTable of Contents

- iShares Core S&P 500 ETF Prospectus

- IVV Sixties Set of 6 Tumbler - Clear - Artelia

- IVV vs VTS: Unveiling the Best ETF for Your Portfolio

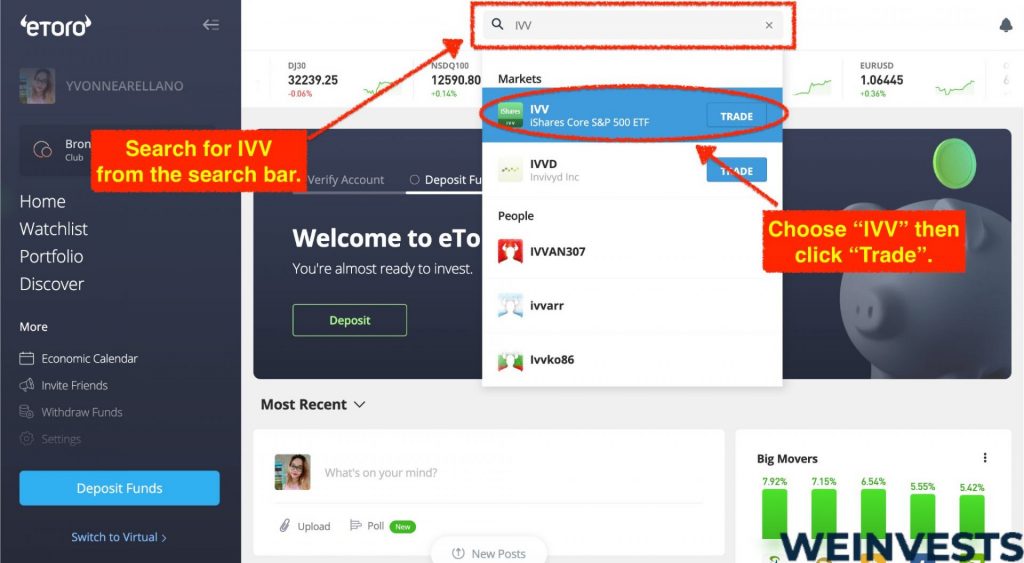

- iShares Core S&P 500 ETF (IVV) - WeInvests

- iShares Core S&P 500 ETF Experiences Big Inflow | Nasdaq

- [หนีดอย] รีวิว ETF ตอนที่ 5 IVV | by หนีดอย 💰 ETF แบบ Passive ลงทุนผ่าน ...

- Compare IVV vs. IVE | Which One is Better?

- iShares Core S&P 500 UCITS ETF USD (Acc) | SXR8 | IE00B5BMR087

- IVV Bombay Individual Bowl Tobacco Decoration - Artelia

- Informe S&P 500 | REGUM

![[หนีดอย] รีวิว ETF ตอนที่ 5 IVV | by หนีดอย 💰 ETF แบบ Passive ลงทุนผ่าน ...](https://t1.blockdit.com/photos/2024/01/65b70e5012c93f83681586f4_800x0xcover_19mZxErm.jpg)

Diversification at its Best

Low Costs and High Liquidity

Consistent Performance

The iShares Core S&P 500 ETF has consistently delivered strong performance over the years, with a 10-year average annual return of over 13%. This is largely due to the fund's ability to track the S&P 500 Index, which has historically provided stable and long-term growth. By investing in this fund, you'll be able to tap into the growth potential of the US stock market, with the added benefit of professional management and diversification.

Transparent and Tax-Efficient

The iShares Core S&P 500 ETF is a transparent fund, with its holdings and performance publicly available. This means that you can easily track the fund's progress and make informed decisions about your investment. Additionally, this fund is designed to be tax-efficient, with a low turnover rate and a focus on long-term investing, which can help minimize tax liabilities. In conclusion, the iShares Core S&P 500 ETF is a stellar stock fund that offers a unique combination of diversification, low costs, and consistent performance. With its broad range of holdings, low expense ratio, and high liquidity, this fund is an attractive option for investors seeking a stable and long-term investment. Whether you're a seasoned investor or just starting out, the iShares Core S&P 500 ETF is definitely worth considering. So why not invest in the best? Add this fund to your portfolio today and start building a stronger financial future.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. It's essential to do your own research and consult with a financial advisor before making any investment decisions.