As the tax season approaches, it's essential to have all the necessary forms and documents in order to ensure a smooth and hassle-free filing process. One of the most critical forms for freelancers, independent contractors, and businesses is the W-9 form. In this article, we'll delve into the world of W-9 forms, exploring what they are, why they're necessary, and how to fill them out using a

fillable, printable, and downloadable W-9 tax PDF form from PDFLiner.

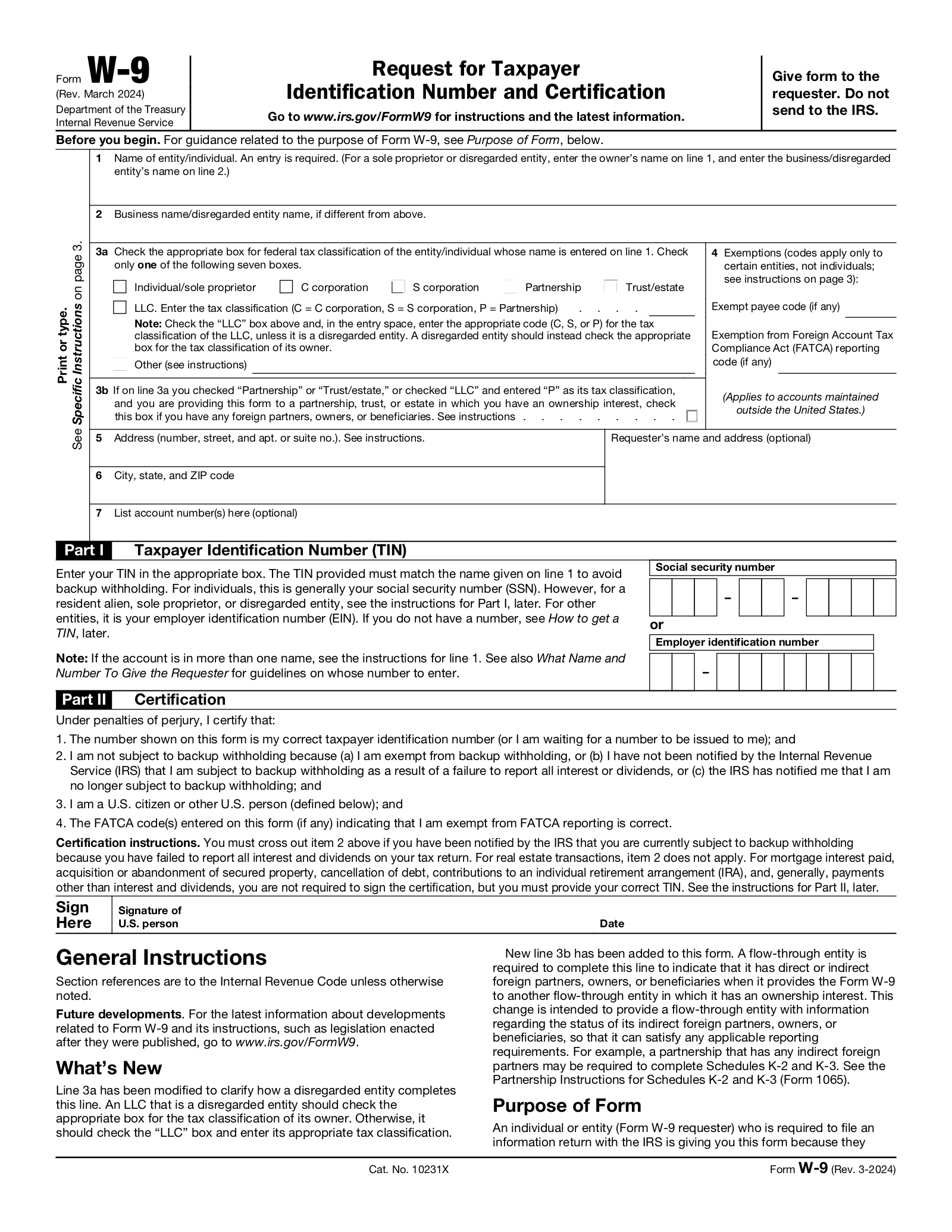

What is a W-9 Form?

A W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is a document used by the Internal Revenue Service (IRS) to collect information from freelancers, independent contractors, and businesses. The form is used to verify the taxpayer's identification number, which can be either a Social Security number (SSN) or an Employer Identification Number (EIN). This information is crucial for tax purposes, as it helps the IRS to track income and ensure that taxes are paid accordingly.

Why is a W-9 Form Necessary?

The W-9 form is necessary for several reasons:

Tax Compliance: The W-9 form helps the IRS to verify the taxpayer's identity and ensure that taxes are paid on time.

Income Reporting: The form is used to report income earned by freelancers and independent contractors, which is essential for tax purposes.

Business Verification: The W-9 form helps businesses to verify the identity of their contractors and freelancers, ensuring that they are complying with tax laws and regulations.

How to Fill Out a W-9 Form

Filling out a W-9 form can be a straightforward process, especially when using a

fillable, printable, and downloadable W-9 tax PDF form from PDFLiner. Here are the steps to follow:

1.

Download the Form: Visit the PDFLiner website and download the 2025 W-9 form.

2.

Fill Out the Form: Enter the required information, including your name, address, and taxpayer identification number.

3.

Verify Your Information: Double-check your information to ensure that it is accurate and complete.

4.

Sign and Date the Form: Sign and date the form, and return it to the requester.

Benefits of Using PDFLiner

Using PDFLiner to fill out your W-9 form offers several benefits, including:

Convenience: The form is easily accessible and can be filled out from the comfort of your own home.

Accuracy: The fillable form reduces the risk of errors, ensuring that your information is accurate and complete.

Time-Saving: The form can be filled out quickly and easily, saving you time and effort.

In conclusion, the W-9 form is a critical document for freelancers, independent contractors, and businesses. By using a

fillable, printable, and downloadable W-9 tax PDF form from PDFLiner, you can streamline your tax filing process, ensuring that your information is accurate and complete. Don't wait until the last minute to fill out your W-9 form – download it today and get ahead of the tax season.