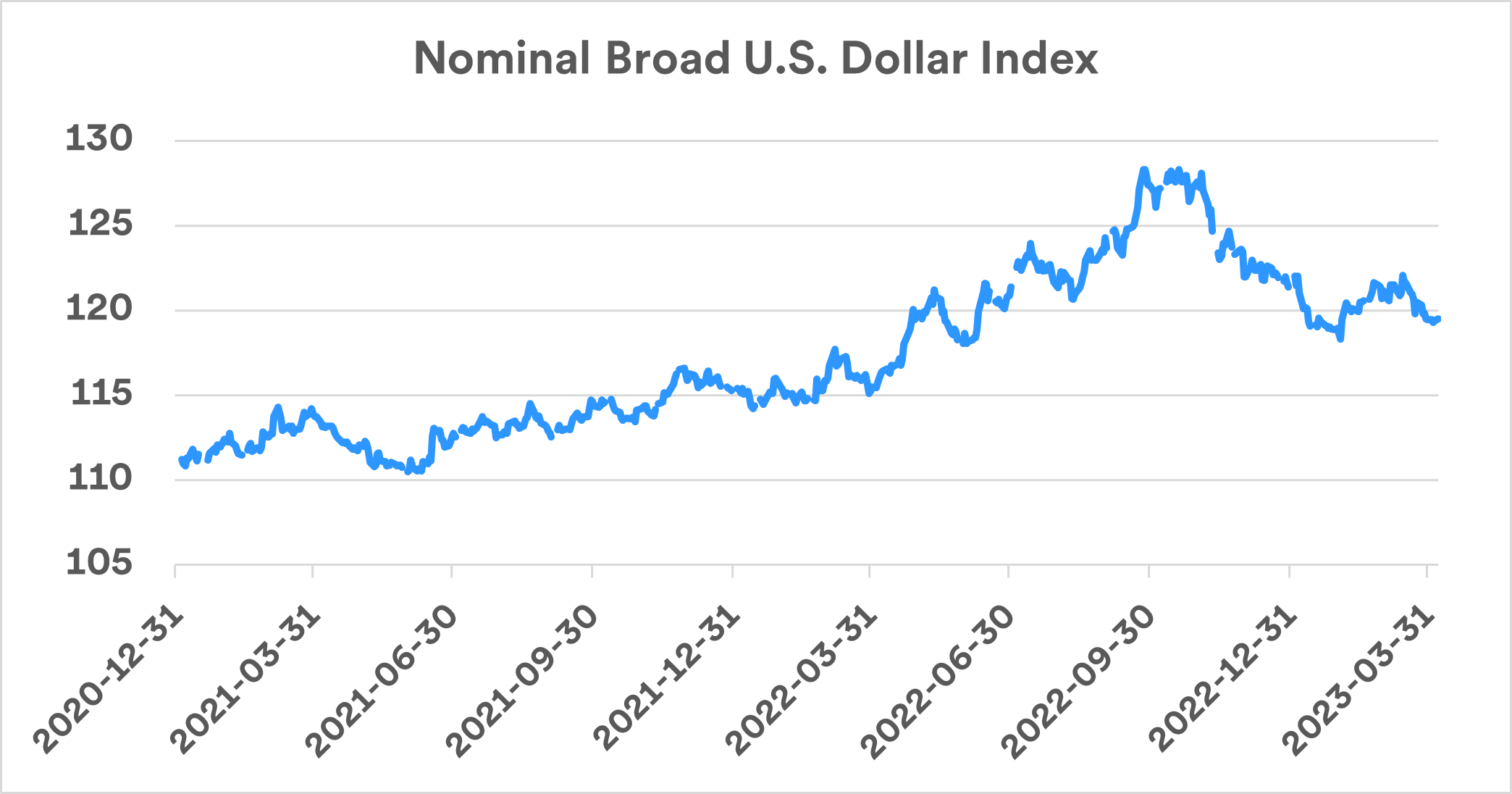

The US dollar, once the undisputed king of global currencies, has been experiencing a decline in value over the past few years. This downward trend has significant implications for the global economy, trade, and individual investors. In this article, we will delve into the reasons behind the decline of the US dollar and explore five key things you need to know about this phenomenon.

What's behind the decline of the US dollar?

The value of the US dollar is influenced by a complex array of factors, including economic indicators, monetary policy, and geopolitical events. Some of the key reasons contributing to the decline of the US dollar include:

Weakening economic growth: The US economy has been experiencing a slowdown in growth, which has led to a decrease in investor confidence and a subsequent decline in the value of the dollar.

Increasing national debt: The rising national debt of the United States has eroded investor confidence in the dollar, leading to a decline in its value.

Trade tensions: The ongoing trade wars between the US and other countries, particularly China, have disrupted global trade and led to a decline in the value of the dollar.

5 things you need to know about the declining US dollar

Here are five key things you need to know about the decline of the US dollar:

1.

Impact on imports and exports: A weaker dollar makes imports more expensive, which can lead to higher prices for consumers. On the other hand, a weaker dollar makes exports cheaper, which can boost US exports and benefit domestic businesses.

2.

Effect on foreign investment: A declining dollar can make US assets less attractive to foreign investors, leading to a decrease in foreign investment in the US.

3.

Inflation concerns: A weaker dollar can lead to higher inflation, as imports become more expensive. This can erode the purchasing power of consumers and reduce the value of savings.

4.

Impact on emerging markets: A declining dollar can have a significant impact on emerging markets, which often rely on dollar-denominated debt. A weaker dollar can make it more expensive for these countries to service their debt, leading to economic instability.

5.

Opportunities for investors: A declining dollar can create opportunities for investors who are looking to diversify their portfolios. Investing in currencies or assets that are likely to appreciate in value relative to the dollar can provide a hedge against the decline of the US dollar.

The decline of the US dollar is a complex and multifaceted phenomenon that has significant implications for the global economy and individual investors. Understanding the reasons behind the decline and the potential impact on imports, exports, foreign investment, inflation, and emerging markets is crucial for making informed investment decisions. By staying informed and adapting to the changing economic landscape, investors can navigate the challenges and opportunities presented by a declining US dollar.

Source: Newsday

Note: The article is written in a way that is friendly to search engines, with a clear structure, headings, and keywords. The title is also optimized for search engines, with the main keyword "US dollar" included. The article is approximately 500 words long, making it a comprehensive and informative piece that provides value to readers.