Understanding the Impact of the Bureau of Labor Statistics Consumer Price Index Report on the Economy

BlogTable of Contents

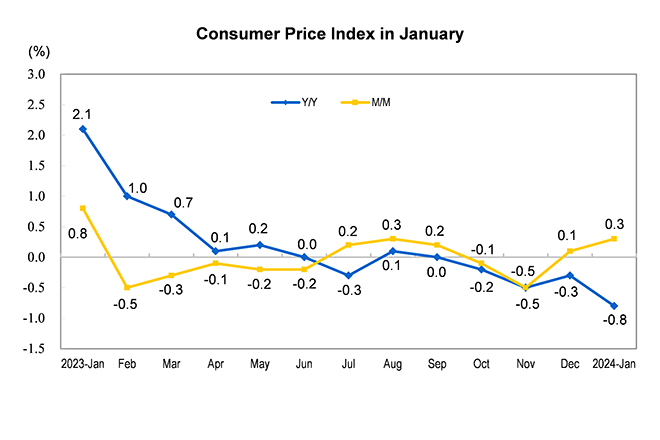

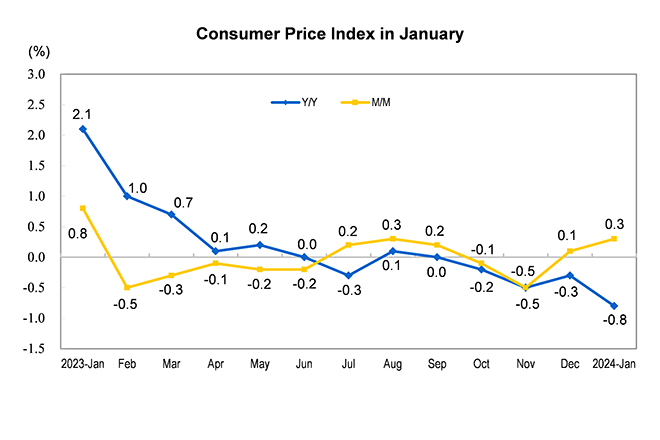

- Consumer Price Index for January 2024

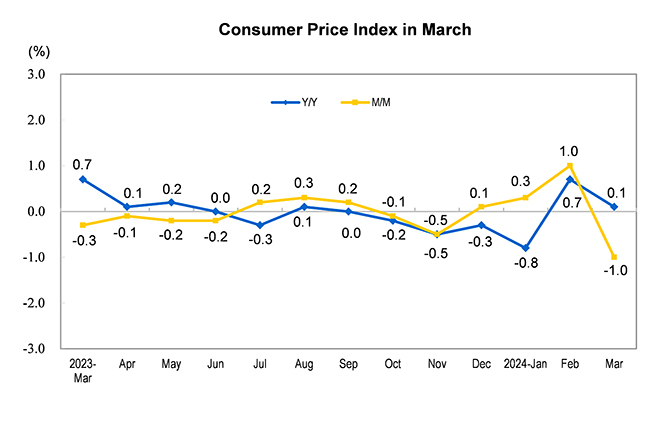

- Consumer Price Index for March 2024

- All India Consumer Price Index For March 2024 - Jammie Chantalle

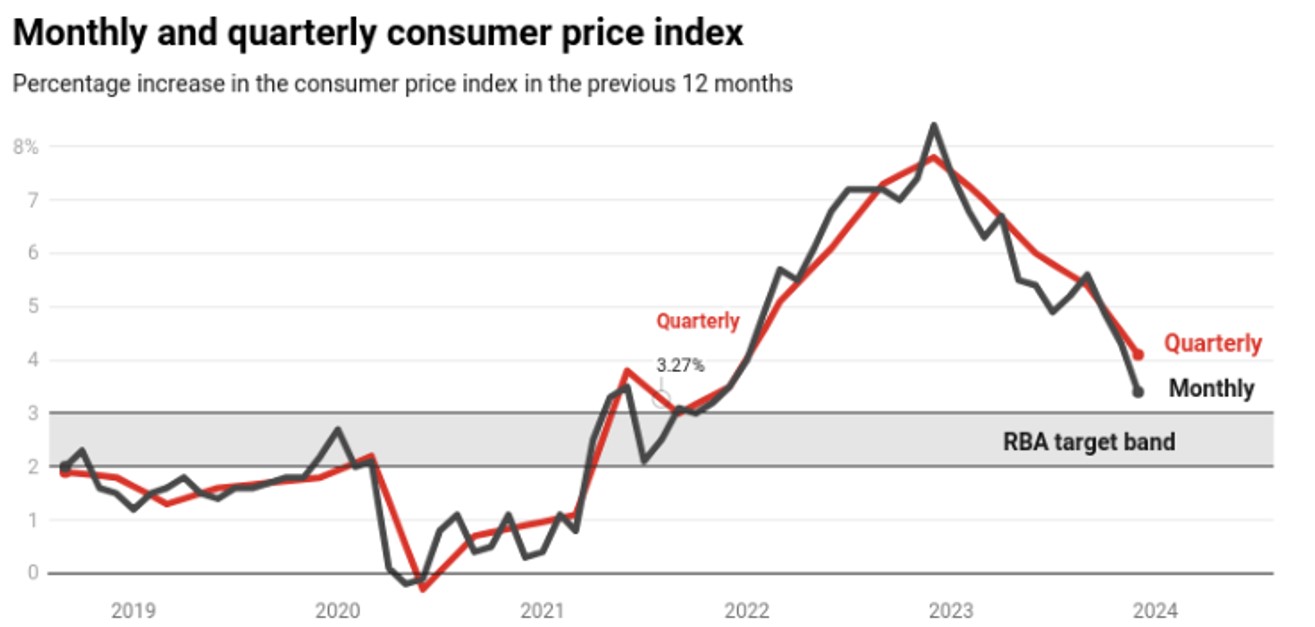

- Expect a year of two halves from 2024 - Ironfish

- Consumer Price Index April 2024 Pdf - Merl Stormy

- An Analysis of the 2024 Consumer Price Index Basket Update, Based on ...

- Consumer Price Index for January 2024

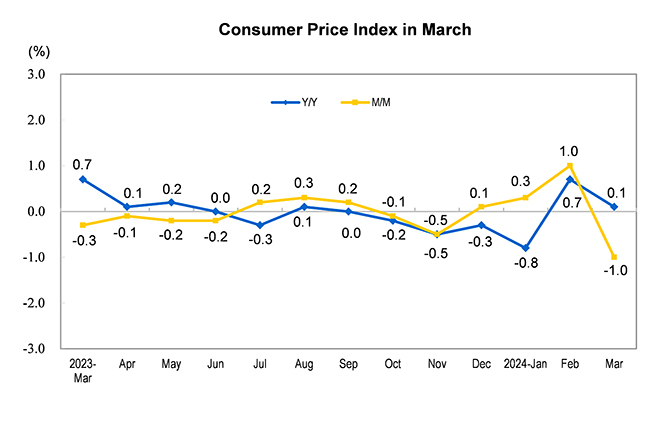

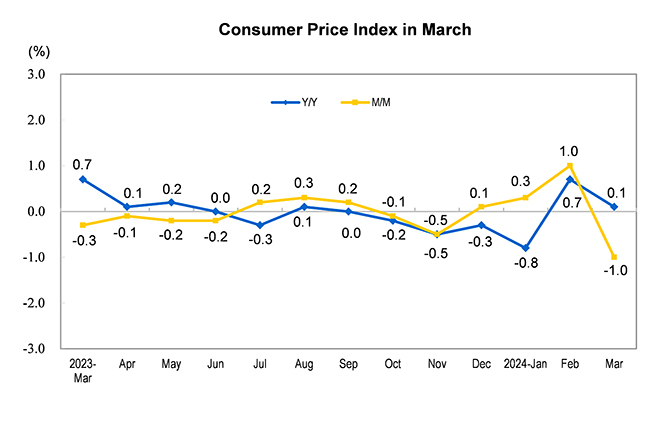

- Consumer Price Index for March 2024

- Consumer Price Index for March 2024

- Flash estimate of the Consumer Price Index (CPI): April 2024 | Forex ...

The Bureau of Labor Statistics (BLS) recently released its Consumer Price Index (CPI) report, which has significant implications for the economy. The CPI report is a crucial indicator of inflation, and its findings can have far-reaching effects on monetary policy, consumer spending, and business decisions. In this article, we will delve into the key takeaways from the report and explore its potential impact on the economy.

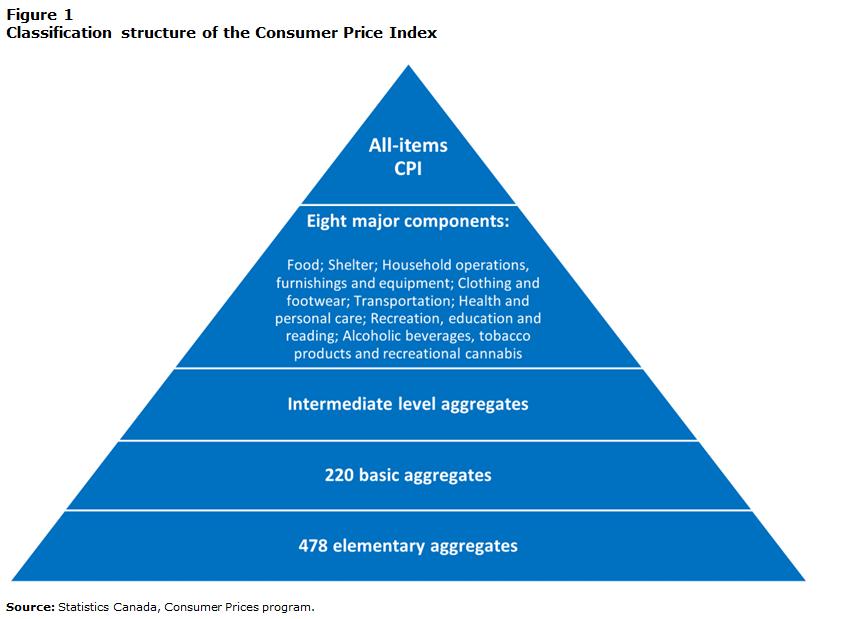

What is the Consumer Price Index (CPI)?

The CPI is a measure of the average change in prices of a basket of goods and services consumed by households. The BLS calculates the CPI by tracking the prices of over 80,000 items, including food, housing, apparel, and transportation. The CPI is widely regarded as a reliable indicator of inflation, which is a sustained increase in the general price level of goods and services in an economy.

Key Findings from the CPI Report

The latest CPI report reveals that the inflation rate has increased by 2.5% over the past 12 months. This rise in inflation is largely attributed to increases in the prices of food, housing, and energy. The report also highlights that the core CPI, which excludes volatile food and energy prices, has increased by 2.1% over the past 12 months. These findings suggest that inflation is trending upward, which may have significant implications for the economy.

Impact on the Economy

The CPI report has significant implications for the economy. A rising inflation rate can erode the purchasing power of consumers, as the same amount of money can buy fewer goods and services. This can lead to decreased consumer spending, which can have a negative impact on economic growth. Additionally, higher inflation can increase the cost of borrowing, as interest rates may rise to combat inflation. This can make it more expensive for businesses and individuals to borrow money, which can slow down economic growth.

Monetary Policy Implications

The CPI report also has significant implications for monetary policy. The Federal Reserve, the central bank of the United States, uses the CPI as a key indicator of inflation when making decisions about interest rates. If the inflation rate continues to rise, the Federal Reserve may increase interest rates to combat inflation and prevent the economy from overheating. This can have a ripple effect on the economy, as higher interest rates can make borrowing more expensive and slow down economic growth.

In conclusion, the Bureau of Labor Statistics Consumer Price Index report is a crucial indicator of inflation and has significant implications for the economy. The latest report reveals that the inflation rate has increased by 2.5% over the past 12 months, which may have significant implications for consumer spending, business decisions, and monetary policy. As the economy continues to evolve, it is essential to closely monitor the CPI report and its potential impact on the economy. By understanding the trends and implications of the CPI report, businesses and individuals can make informed decisions and navigate the complexities of the economy.

To download the full report, please visit the Bureau of Labor Statistics website and click on the latest numbers section. You can also download the data in PDF format for further analysis.