UnitedHealth Group Inc (UNH) Stock Price & News: A Comprehensive Analysis

BlogTable of Contents

- UNH Stock Price Today (plus 7 insightful charts) • Dogs of the Dow

- UNH Stock Price and Chart — NYSE:UNH — TradingView

- Why Did Option Value Decline After Stock Price Accelerated? A Real-Life ...

- 3 Bullish Stock Picks for Week Ahead (BA CVX UNH) | InvestorPlace

- UnitedHealth (NYSE:UNH) Backed by Bullish Analysts Ratings | Markets ...

- UnitedHealth Group Q3: Market Leaders Never Come Cheap (NYSE:UNH ...

- 4 Top Stock Trades for Thursday: NFLX, F, UNH, QQQ | InvestorPlace

- Is UnitedHealth Stock a Buy Now!? | UnitedHealth (UNH) Stock Analysis ...

- Chartology: Unitedhealth Group (UNH) - See It Market

- UnitedHealth Stock: Valuation Is Holding Me Back (NYSE:UNH) | Seeking Alpha

UnitedHealth Group Inc (UNH) is one of the largest health insurance companies in the United States, providing a wide range of health care services and products to individuals, employers, and governments. As a leading player in the health care industry, UNH stock price and news are closely watched by investors, analysts, and industry experts. In this article, we will provide an overview of UnitedHealth Group Inc (UNH) stock price and news, including its current performance, trends, and outlook.

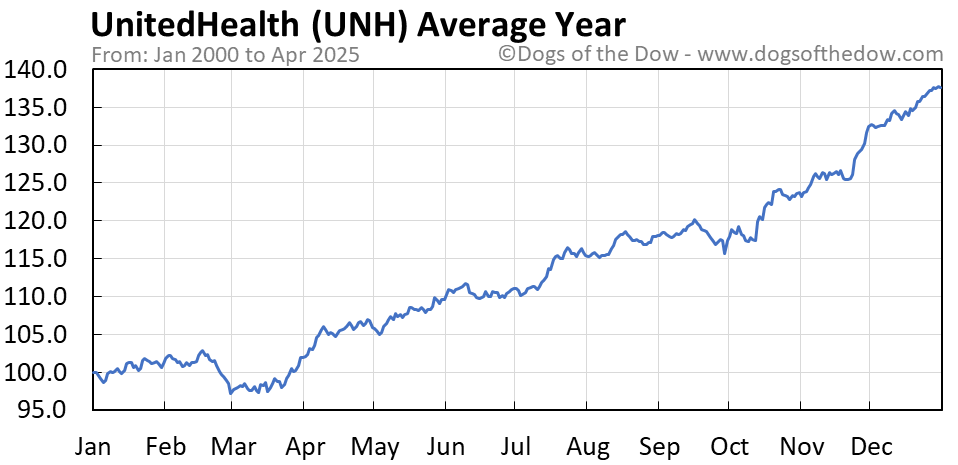

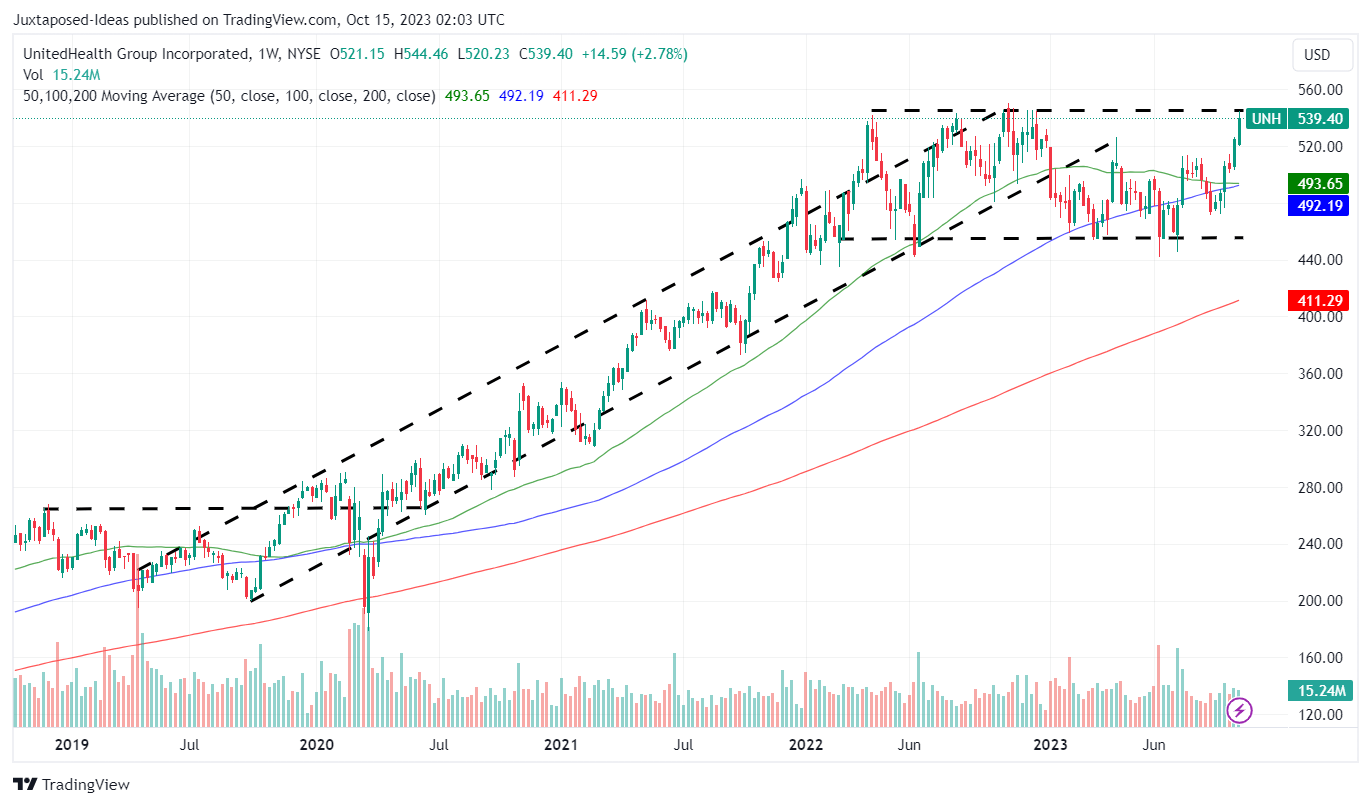

Current Stock Price and Performance

As of the latest update, the UnitedHealth Group Inc (UNH) stock price is trading at around $410 per share, with a market capitalization of over $380 billion. The stock has been performing well in recent years, with a steady increase in value over the past five years. In fact, UNH stock has outperformed the S&P 500 index, with a return of over 150% compared to the index's return of around 100% over the same period.

News and Updates

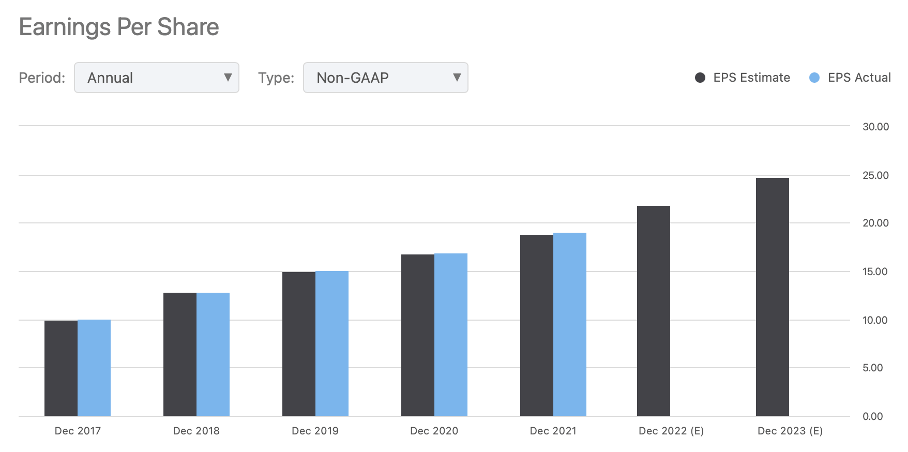

UnitedHealth Group Inc (UNH) has been in the news recently due to its strong financial performance and strategic acquisitions. The company reported a net income of $13.3 billion in 2022, up 10% from the previous year. UNH has also been expanding its presence in the health care industry through acquisitions, including its purchase of DaVita Medical Group, a leading provider of health care services to patients with chronic conditions.

In addition, UnitedHealth Group Inc (UNH) has been investing heavily in digital health technologies, including artificial intelligence and telemedicine. The company has partnered with several start-ups and established companies to develop new health care solutions, including a virtual care platform that allows patients to access medical care remotely.

Outlook and Trends

The outlook for UnitedHealth Group Inc (UNH) stock is positive, driven by the company's strong financial performance, strategic acquisitions, and investments in digital health technologies. The health care industry is expected to continue growing, driven by an aging population and an increasing demand for health care services. UNH is well-positioned to benefit from these trends, with its diversified portfolio of health care services and products.

However, there are also potential risks and challenges facing the company, including regulatory changes, competition from other health insurance companies, and the impact of the COVID-19 pandemic on the health care industry. Despite these risks, analysts expect UNH stock to continue performing well, with a target price of around $450 per share.

In conclusion, UnitedHealth Group Inc (UNH) stock price and news are closely watched by investors and industry experts due to the company's leading position in the health care industry. With its strong financial performance, strategic acquisitions, and investments in digital health technologies, UNH is well-positioned for long-term growth and success. While there are potential risks and challenges facing the company, the outlook for UNH stock is positive, making it a attractive investment opportunity for those looking to invest in the health care industry.

For the latest news and updates on UnitedHealth Group Inc (UNH) stock, please visit Google Finance. You can also follow UNH stock price and news on other financial websites and social media platforms.

Note: The information provided in this article is for general information purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor or conduct your own research before making any investment decisions.